Questions Mount about Frederick County Conservative Club's Tax Status

Activities of the Controversial Group may violate their status, Articles of Incorporation

Questions are beginning to mount about the status of the Frederick County Conservative Club and whether or not they are violating their tax status by engaging in political behavior.

The Frederick County Conservative Club is filed as a non-profit organization with the IRS, though there is some confusion as to whether or not they are classified as a 501(c)3 organization or a 501(c)4 organization.

The group also filed to file their tax forms with the IRS for the 11/01/2018- 10/31/2019 tax year.

The difference in non-profit status important, but not critical, to the questions being raised. 501(c)3 organizations are entities that are organized and operated exclusively for religious, charitable, scientific, literary, or educational purposes; or for testing for public safety, to foster national or international amateur sports competition, or for the prevention of cruelty to children or animals.” 501(c)4 organizations are social welfare groups.

The major difference is that 501(c)3 organizations are prohibited from doing any activities that are campaign activities for or against a candidate for public office. 501(c)4 groups:

are allowed to participate in politics, so long as politics do not become their primary focus. What that means in practice is that they must spend less than 50 percent of their money on politics. So long as they don't run afoul of that threshold, the groups can influence elections, which they typically do through advertising.

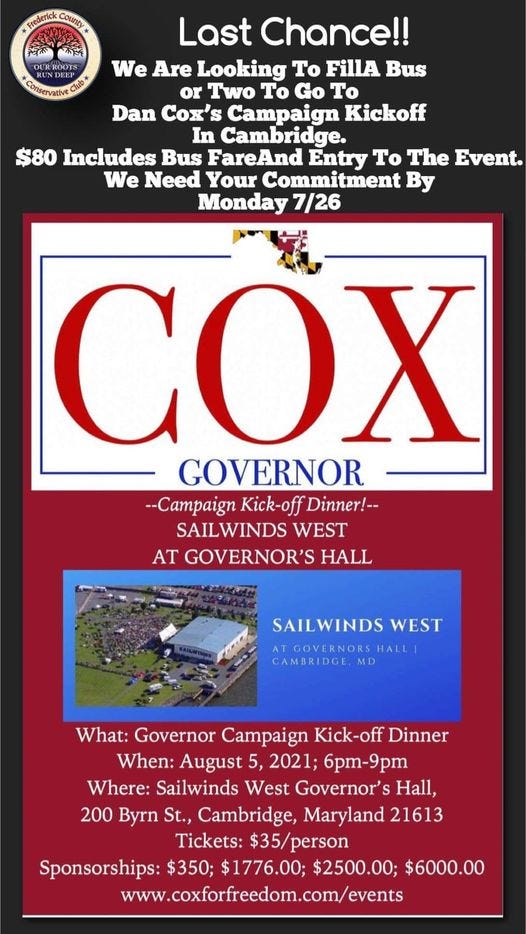

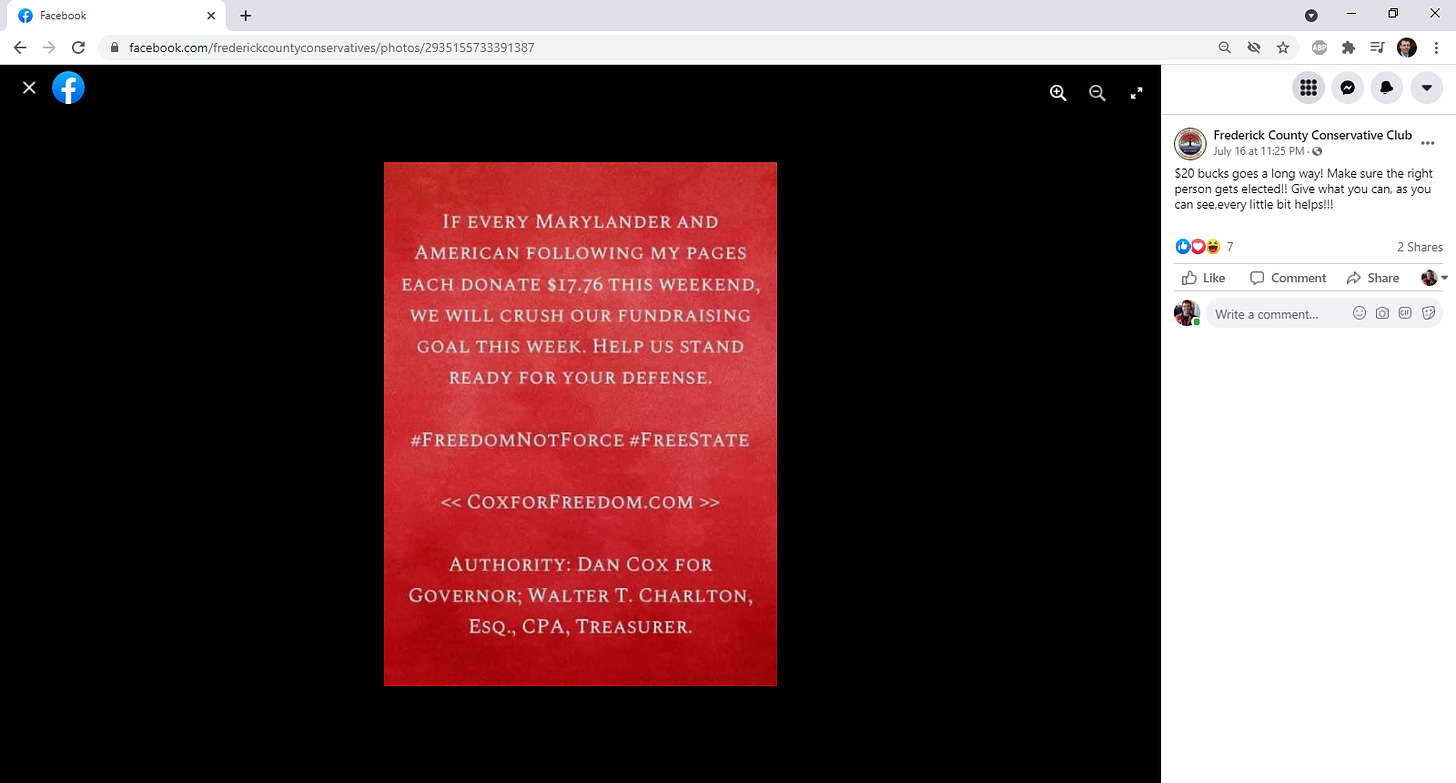

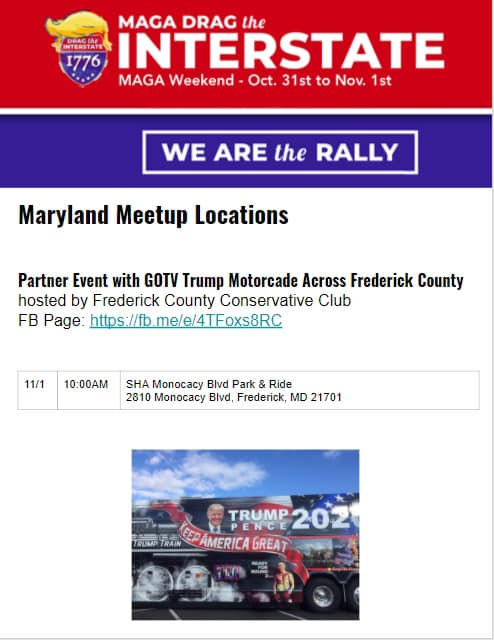

The Frederick County Conservative Club however, has been participating in electoral politics as recent activities indicate. The Club has been actively promoting Dan Cox’s gubernatorial candidacy, particularly on social media.

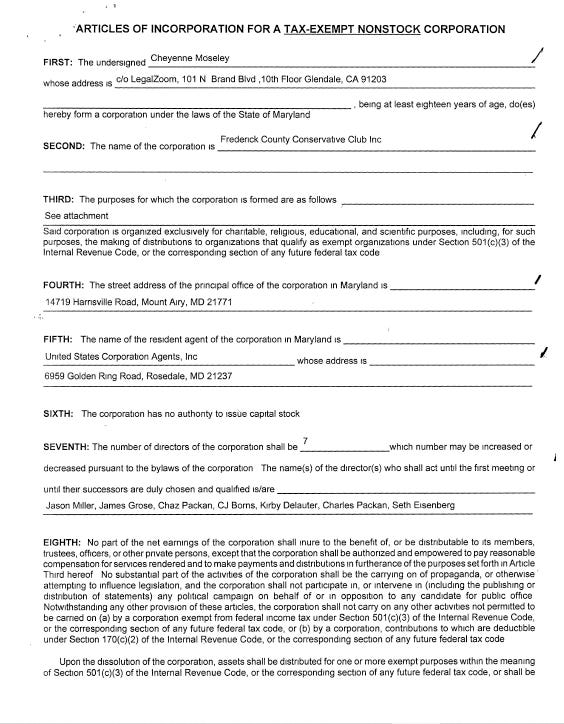

Regardless of whether their tax status is 501(c)3 or 501(c)4 is with the IRS, the Frederick County Conservative Club identifies as a 501(c)3 with the state of Maryland. On top of that, their Articles of Incorporation on file with the state say:

No part of the net earnings of the corporation shall inure to the benefit of, or be distributable to its members, trustees, officers, or other private persons, except that the corporation shall be authorized and empowered to pay reasonable compensation for services rendered and to make payments and distributions in furtherance of the purposes set forth in Article Third hereof. No substantial part of the activities of the corporation shall be the carrying on of propaganda, or otherwise attempting to influence legislation, and the corporation shall not participate in, or intervene in (including the publishing or distribution of statements) any political campaign on behalf of or in opposition to any candidate for public office. Notwithstanding any other provision of these articles, the corporation shall not carry on any other activities not permitted to be carried on (a) by a corporation exempt from federal income tax under Section 501(c)(3) of the Internal Revenue Code or the corresponding section of any future federal tax code, or (b) by a corporation, contributions to which are deductible under Section 170(c)(2) of the Internal Revenue Code, or the corresponding section of any future federal tax code

Based solely on what we have seen regarding Dan Cox, the Club is in violation of its own bylaws on file with the state by supporting Cox’s candidacy. But there’s plenty of other activities as well, including outright endorsement of candidates.

The key takeaways from all of these questions are:

The Frederick County Conservative Club, which demands that politicians follow the club’s interpretation of the Constitution, can’t follow their Club’s own bylaws;

The Club, if it is filed as a 501(c)3 or a 501(c)4 with the IRS, may be in violation of the tax code for its political activities;

If the Club is now filed as a 501(c)3 its filing status is in contradiction with its own filed status with the state of Maryland per its Articles of Incorporation on file.

I have no issues with the Frederick County Conservative Club supporting whomever they want. However, these questions deserve answers and people need to know why the club is in violation of its own Articles of Incorporation.

Oh rubbish! Most Grassroots political advocacy groups are 501c3. They do no direct lobbying and even if they did, they are allowed to spend 5% of their budget on lobbying

Wow. Stopped by for hard hitting reporting and got nothing more than innuendo.